Stock analysis market is helping us feel a little overwhelmed right now. It seems so confusing and full of new products that are trying to reinvent the wheel. With a vast number of options available to you, wading through the noise to determine which solutions work and provide the best ROI is no small task.

To help you find the best platform for stock analysis in a sea of options, we’ve taken an in-depth look at the top offerings on the market today. In this post, we share our discovery of the 8 best tools, as we dive into these platforms’ main features, tier options and structure. Whether you’ve been investing for decades or are just starting out, our analysis of the best online stock trading platforms will help you find the right tool to really bolster your portfolio and get things moving in the stock market.

Website List

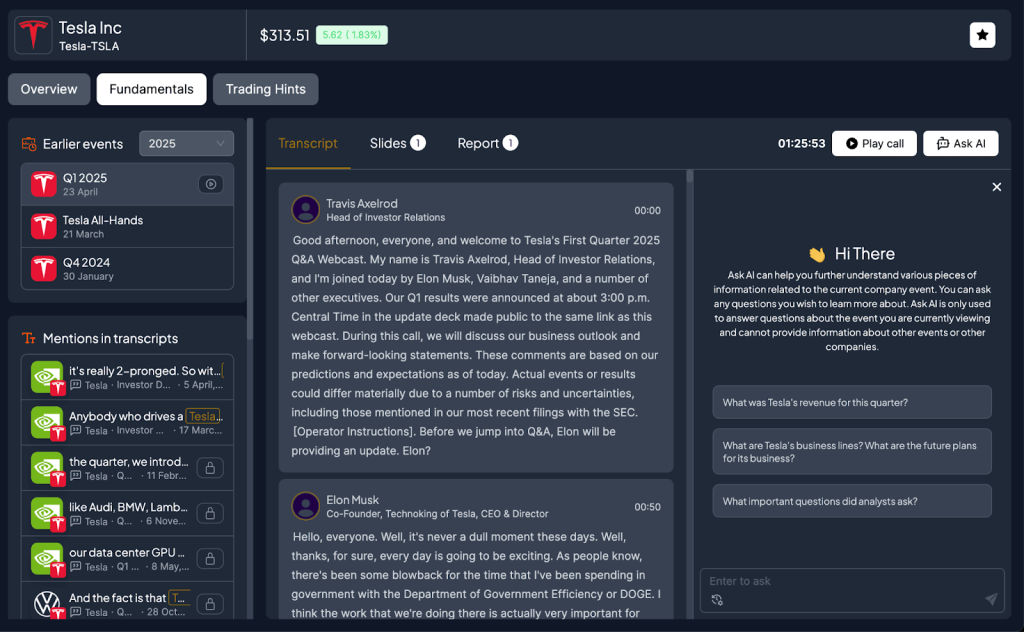

1. BestStock AI

What is BestStock AI

BestStock AI Beststock ai is an AI-based stock analysis platform that helps to make investment decision better and easier through automated financial analysis, smart outfit suggestions. Its use case is handing over data to investment teams so that they do not have process the financials and earnings transcripts of public companies too, allowing them in turn to spend more of their time crunching numbers around smarter, more informed portfolio management. With an abundance of auto-generated reports and in-depth statistics, BestStock AI will make your decision-making easier (as you won’t have to go through the pain of charting data manually like in ancient times). With the BestStock AI Capital Gains Tax Calculator, it’s also making calculations on tax to be paid on investments an easy task… which leads to more informed decisions and potentially better investment results.

Features

- AI for financial analysis that automatically processes the data and provides actionable insights with no manual work involved

- Search stocks based on their financials and earnings based transcripts!!!

- Unobtrusive daily market intelligence by AI that delivers timely and relevant research/insights

- Sophisticated statistical and business analysis software for comprehensive financial analysis

- Easy to use and very beginner friendly and also perfect for professionals

Pros and Cons

Pros:

- Driven by AI: It’s all about the least amount of manual work needed to get actionable insights

- US Stock financials and earnings transcripts you ever need at your fingertips

- Research workflow improves investment team productivity

- Daily AI generated insights and curated research helps users make smarter investment decisions

Cons:

- The cost is a little high for what it is, compared to other apps like it.

- It provides some off-line functionalities for data access and computation.

- It might take extra time to really familiarize oneself with the full toolkit.

2. Morningstar

What is Morningstar

Morningstar is a top investment research company offering an extensive line of data and analysis reports on numerous types of investments such as stocks, mutual funds, and exchange-traded funds (ETFs). Its primary aim is to provide investors with the connections, tools and resources necessary to make educated investment decisions.Complete with portfolio management, performance tracking and access to comprehensive research reports. Morningstar provides trusted and unbiased ratings, long-term fund performance data and investment research, including the analysis of fund holdings at the security level and an early warning service to help investors avoid potential value traps within their portfolios

Features

- User interface that is as logical to use as it is visually appealing.

- Live data analytics to prompt decision-making and strategic insights

- Expandable systems that can accommodate your business requirements and capabilities

- Strong collaboration tools that will improve team productivity and communication

- Reporting tools for monitoring response and success

Pros and Cons

Pros

- The portfolio tracking on Morningstar is easy to manage and simple to load up and update positions, making it appropriate for investors of any level.

- The site provides in-depth category, sector and market analysis to help investors customize views of their investments.

- It’s always good to be using the work of Morningstar, whose research and analysis is some of the best in finance.

Cons

- The advanced features are only available through a subscription – and they might be too expensive for casual or non-professional investors.

- Investors may need to be careful not to rely on any one of them, however: A Morningstar star rating is a backward-looking computation whose results can’t predict future performance.

- For less experienced investors, the advanced platform features and the data they display can be intimidating and may be misinterpreted.

3. Seeking Alpha

What is Seeking Alpha

Seeking Alpha offers a combination of free and premium services for investors who want timely market moving news and analysis covering everything from stocks to the economy. Its core mission is to inform, educate and motivate laboratory decision makers so that their firms can better complete in the explosive lab industry. Seeking Alpha has a great mix of news and analysis on U.S. markets, with an emphasis on ‘crowd-sourced’ content and expert commentary for both new investors and market veterans.

Features

- Unlimited read of stock breaking news for your wise investment decision

- More analysis on news: It never hurts to try to understand your initial thoughts on stock ratings

- Full logging of US and world commodities and futures periods

- Intuitive asIIF platform allows easy to use account creation and management

- Updates to provide you the best market insights and news.

Pros and Cons

Pros:

- Unlimited access to breaking stock news and analysis articles

- Community-based insights and robust stock ratings

- Dependent on different markets such as commodities and futures

- User-friendly account creation process

Cons:

- Risk that the move to update constantly would cause information overload.

- The fact that the site is not fully mobile-friendly might impact on browsing experience using a smartphone

- You must sign in to see anything, which some people might find a hassle

4.Simply Wall St

What isSimply Wall St

Simply Wall St Simply Wall St is an innovative investment platform that offers free portfolio tracking, analysis and top stock research reports. It was designed to help making investing easier for everyone with detailed analysis of every stock and performance including whether a particular stock is bullish or bearish. Whether you are new investor or experienced who want to look at their portfolio they can use this as a tool to track their stocks performance pending one’s investment strategy. Intuitive and easy to use, Simply Wall St cuts through the complication for the people who just want to invest and stay informed.

Features

- Handholding interfaces for beginners

- Sophisticated portfolio management that empowers informed investment decisionsBeautiful visual data presentation to help non-finance users better understand complex financial details.

- Customer-oriented service with efficient problem-solving ethical actions and responsive results

- Ongoing feature updates based on user feedback to improve overall investing experience

Pros and Cons

Pros:

- Easy-to-navigate interface suitable for both newbie and advanced investors

- Clear data that save you time and improve information retrieval

- Convenient to upload your portfolio and manage the performance efficiently

- Quality insights for making well informed decisions

Cons:

- Could take some time for those new to stock trading played notes$name.

- More limited than more expansive financial tools

- Full access may rely on an internet connection, some of the features are less effective offline

5. MarketBeat

What is MarketBeat

MarketBeat empowers individual investors to make better trading decisions by providing real-time financial data and objective market analysis. The site has various other tools such as real-time stock quotes, dynamic intra-day charting, custom-built portfolios, and message boards for SleekMoney that allow consumers to discuss their favorite stocks and newsworthy events. MarketBeat’s robust options or stock screening tool offer simple ways to find investment opportunities that meet your criteria, zeroing in on stocks and ETFs in the same way you might screen for mutual funds. It also offers a set of unique tools to help analyze ratings, earnings reports, dividend announcements and insider trades. Featuring a sleek, easy-to-use interface and powerful investment tools, unparalleled access and world-class innovative research are available to help you invest smarter.

Features

- Deliberating conceptual movement following innovative trading algorithms in tech stocks.

- Latest prices of significant price moving and market driven Information updated promptly for informed decision making

- Robust analysis into new and emerging sectors such as AI energy, and cybersecurity for strategic investment potential

- Comprehensive summary of the day’s most important stocks strengthening and weakening at-a-glance to aid you invest wisely.

- Analysis of the stock market’s response from experts to help inform both new and seasoned investors

Pros and Cons

Pros:

- What AI development says about the future value of tech stocks.

- Provides investment information for investors of all types in companies on various exchanges.

- Sector coverage ranging from energy and cybersecurity provides a wide array of investing ideas

- Regular tracking of stock performance to update investor on same.

Cons:

- Content can be too fixated on short-term market moves

- Speeding up the pace of updates might cause information overload for some investors

- Lack of substantial coverage on fundamental analysis may not engage those with interest in long term investment strategies

6. StockInvest

What is StockInvest

StockInvest is an online service for stock market analysis and investment strategy. Its primary mission is to enable individual investors with the ability to have access to real-time market data, news and advice from experts as well as ideas on their portfolios. Combining an intuitive interface with educational and analytical tools, StockInvest is designed to enrich the overall trading experience for beginners as well as more advanced traders.

Features

- Easy to use user interface, designed with simplicity in mind for great navigation and easy access.

- Advanced analytics instruments building on the data-driven basis to produce actionable information with which effective decitions can be made

- Scale your services as you grow Designed to support business longevity

- Powerful collaboration tools to bring together teamwork and communication across departments

- Robust resources and onboarding to ensure excellent utilization and adoption

Pros and Cons

Pros

- StockInvest uses state of the art AI analysis tools, such as GPT-4, to analyze stocks in depth.

- There is a standard 3-click process used in stock analysis which makes it easy to use for anyone.

- It combines technical analysis, fundamental data and the news to extract actionable Insights.

Cons

- There’s also the risk an AI-driven analysis might miss some subtlety of human expertise.

- You will need some background knowledge of TA to take full advantage of its functionalities.

- The AI-focus of the platform could alienate armed to the teeth investors whose views on finance are old school.

7. StockTitan

What is StockTitan

StockTitan is an AI based platform that summarises focused stock related news updates in real time, for individual stocks only – minus all the unnecessary noise of stories unrelated to the financial markets for traders and investors. It is designed for empowering trading decisions with state-of-the-art tools such as Rhea-AI, which focuses on sentiment analysis and vital insights extracted from the most recent news so that users have an opportunity to make more intelligent investment decisions. Users long the type of speed and immediacy they get from Stock Titan’s proprietary News feed!

Features

- You get instant stock market news, with a dedicated news feed for each individual stock you choose to watch (i.e. Apple News Feed or Facebook News Feed)

- Sophisticated AI-based sentiment analysis and impact evaluation for traders who want the ultimate in decision support

- Breakneck speed for downloading critical market news, keeping you at your trading edge

- The intuitive platform offers line-in trading and streamlined efficiency

- Free access to a live stock market news feed – ideal for both buying and selling so you can make informed decisions without cost

Pros and Cons

Pros:

- Real-time updates on individual stocks that provide investors with timely information

- AI driven insights and sentiment analysis for improved trading decisions

- Personalized news feed with no unrelated finance stories for a distinct sense of information

- Free version to let you try the service without obligation

Cons:

- Can be intimidating for new users because of the high-tech AI components

- No customizations for fine tuning the news feed to individual trading strategies

- Some traders, especially the most traditional analysts, might bristle at ceding to AI

8. Briefing.com

What is Briefing.com

Briefing.com is a premier financial analysis website offering real-time commentary and action-oriented research. Backed by more than 30 years of experience, the platform provides high-quality analysis on stocks and IPOs, business and macro trends, as well as earnings events with updates in real time, both short- and long-form reports and proprietary tools. With its rapid, precise, and independent analysis, the platform helps investors make informed decisions with features such as In Play alerts, earnings calendars, and sector breakouts. From following growth stocks, value plays or market moving news, Briefing.com is the integrated speed and expert-based website investors need to stay ahead in fast-moving markets.

Features

- User-friendly system for easy browsing and an efficient workflow

- The use of real-time analytics and reporting to support insight-led decision-making

- Expandable capabilities that can be scaled to meet your evolving business requirements and higher-level usage profiles

- Extensive API enabling fast customization and seamless integration with your infrastructure

- Extensive training materials / documentation to help you hit the ground running

Pros and Cons

Pros:

- High scalability for growing business needs

- Intuitive interface allows users to navigate and use app with ease

- Strong security measures for secure data storage

- Frequent updates improving the display and management of content/alimentary business

Cons:

- It may be difficult to set up initially.

- Some of the advanced features take practice

- Fewer third-party integrations than rivals

Key Takeaways

- Do your due diligence when picking a stock analysis tool — not all of them are created equal, so not all of them will provide the same level of information.

- If the stock analysis options available suit your investment goals and tolerance for risk, do take enough time to look into them.

- Try free trials or demo accounts if possible to see how the platform operates before you commit any funds.

- Learn from the experience of other traders by reading reviews and testimonials from users of the stock analysis tools.

- Keep abreast with new stock picking tools, techniques and market indicators.

- Do not underestimate the value of customer support and educational materials that the stock analysis platform offers.

- Think about the ability to scale with your investment strategy and portfolio size.

Conclusion

This article allows you to make informed decisions about investing in the increasingly competitive markets. All the solutions have distinct differences regarding strength and features, and it’s critical to analyze your specific needs, budget, and forward-looking strategy before choosing between the two. The range of these products is the broadest spectrum on which you are free to pick as they also have a varying level of supports, data estimates and trend determination tools from basic to comprehensive.

Stock analysis is changing quickly, with new options becoming available and improving all the time. We suggest you begin with those that seem a good fit for what you need most right now, but also consider their potential to expand and adjust as your investment planning changes. Keep in mind that the most costly option might not always be the best, and just because something has more features does not make it an ideal fit for you. Don’t be afraid the take advantage of free trials and demos offered by these software to give them a test run, also don’t hesitate to contact customer support with any questions. The best stock analysis tool can help you make better decisions on whether to invest in a certain business, and spending some time and money to learn the right one will never be a waste of investment. Begin looking into your options today asap and take your stock trading to another level!

Email your news TIPS to Editor@Kahawatungu.com — this is our only official communication channel