How to Make a Payslip for Self Employed

How to make a payslip for self employed individuals is an important topic for freelancers, consultants, contractors, and small business owners who need proof of income. Even if you work for yourself, a payslip is often required when applying for loans, renting a house, opening credit accounts, or keeping clear financial records. A self employed payslip helps show consistent earnings, deductions, and net income in a professional and organized way.

-

Understand why a self employed payslip is needed

Before creating a payslip, it is important to know its purpose. A payslip for self employed people is mainly used for record keeping and verification. It helps to:

- Prove income to banks or landlords

- Track monthly earnings and expenses

- Show tax deductions clearly

- Maintain professional financial records

Even without an employer, a payslip adds credibility to your income.

-

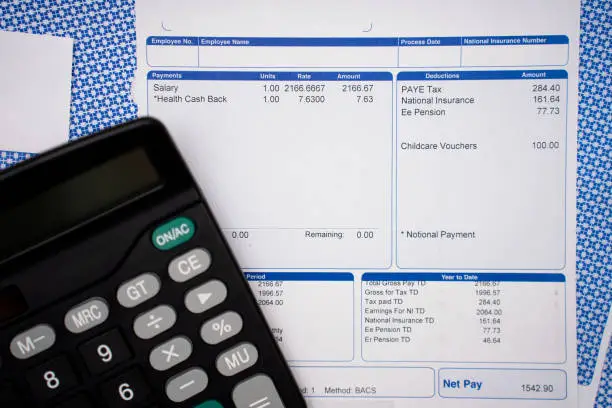

Know what information a payslip should include

A proper payslip must contain clear and accurate details. A self employed payslip should include:

- Your full name or business name

- Pay period date

- Gross income earned

- Deductions such as tax or expenses

- Net income after deductions

Including this information makes the payslip look official and acceptable.

-

Calculate your gross income correctly

Gross income is the total amount you earned before deductions. To calculate it:

- Add all payments received during the period

- Include hourly, contract, or project payments

- Exclude personal loans or gifts

Accurate gross income figures are essential for trust and transparency.

-

List deductions clearly and honestly

Deductions show how your gross income is reduced. Common deductions for self employed people include:

- Income tax

- Business expenses

- Medical aid or pension contributions

- Loan repayments if applicable

Always ensure deductions are realistic and match your records.

-

Calculate net income

Net income is what remains after deductions. To calculate net income:

- Subtract total deductions from gross income

- Ensure the final amount matches your actual take-home pay

Net income is often the most important figure for financial institutions.

-

Choose a format for the payslip

A payslip can be created using simple tools. Common options include:

- Microsoft Word

- Excel spreadsheet

- Google Docs or Sheets

- Payslip templates

Choose a clean and professional layout that is easy to read.

-

Create the payslip step by step

When creating the payslip:

- Add a clear title such as “Payslip”

- Enter your personal or business details

- Fill in income and deductions

- Double-check all calculations

Accuracy is more important than design.

-

Add a declaration or note

Because you are self employed, adding a short declaration helps. You can:

- State that the payslip is self-generated

- Confirm that the information is true

- Include your signature or digital signature

This increases credibility.

-

Save and store payslips properly

Once completed, store your payslips safely. You should:

- Save digital copies as PDF

- Back them up securely

- Keep records for tax purposes

Organized storage helps in the long term.

Also Read: How to Make a Man Cry for You