Second money laundering suspect arrested in Nairobi Over USD 217,900 gold scam

Sleuths from the Directorate of Criminal Investigations’ Operation Support Unit (OSU) arrested a second suspect in connection with the laundering of USD 217,900 believed to be proceeds of a gold scam that targeted an American national.

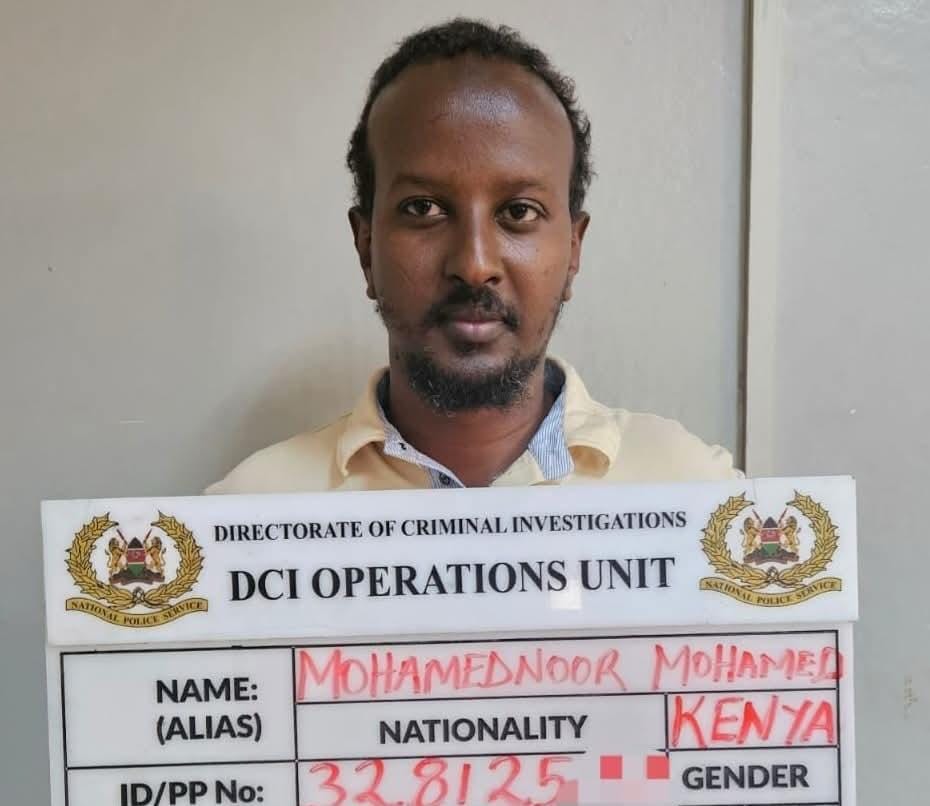

The suspect, Mohammed Noor Muhyadhin Mohammed, a Nairobi-based businessman and sole proprietor of Mohazcom Trading, was apprehended as investigators intensified their probe into what authorities describe as a well-coordinated fraud scheme.

His arrest follows the earlier arraignment of Willis Onyango Wasonga, alias Marcus, who appeared before the Milimani Law Courts on February 16, 2026.

Wasonga faces multiple charges, including conspiracy to defraud and obtaining money by false pretences under the Penal Code, as well as acquisition, possession and use of proceeds of crime contrary to provisions of the Proceeds of Crime and Anti-Money Laundering Act (POCAMLA) No. 9 of 2009.

Investigations reveal that on February 3, 2026, Mohammed allegedly received a swift transfer of USD 217,900 through his company’s account at the National Bank of Kenya.

The funds had reportedly been debited from the accounts of MOAC Advocates, also held at the same bank.

The money was purportedly payment for 495 kilograms of gold that was never delivered to the victim.

Detectives say that shortly after the funds were credited, Mohammed wired the entire amount overseas to accounts held by Tecno Mobile Limited at Citibank in Hong Kong, allegedly to facilitate a shipment of mobile phones that has yet to arrive in Kenya.

Forex Bureau Link

Further inquiries have established that Mohammed maintained a long-standing business relationship spanning over a decade with a forex bureau located along Standard Street in Nairobi.

Investigators believe the bureau, working closely with its proprietor, may have played a central role in facilitating substantial cross-border transfers, including the transaction under scrutiny.

Alleged Cover-Up

In what detectives describe as an attempt to legitimize the suspicious transaction, MOAC Advocates reportedly presented a debt settlement agreement allegedly signed by Mohammed and another suspect still at large.

However, investigators have dismissed the document as a smokescreen designed to conceal the fraudulent scheme.

Mohammed remains in custody pending arraignment, while detectives pursue three additional suspects believed to be part of the network.

Authorities say the case underscores the DCI’s commitment to dismantling gold scam syndicates and curbing money laundering operations that exploit foreign investors and undermine Kenya’s financial integrity.

Police have been pursuing dozens of cases of money laundering in a series that have shocked many.