Take Control of Your Taxes in 2026 With TaxTools.ai

Take Control of Your Taxes in 2026 With TaxTools.ai

Taxes are involved in almost all of your financial choices, including the choice of a job or budgeting your monthly payments. In the year 2026, when the IRS brackets are restructured and the state tax regulations are in a state of flux, using the old calculators may cost you a lot of money. TaxTools.ai represents a smarter, more reliable way to calculate taxes, as the service makes it easier and faster to estimate taxes, keeping Americans informed throughout the year.

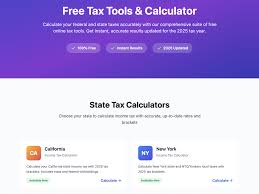

Tax tools online is a simple and accurate tax calculator designed to simplify and break down the federal and state taxes without complex forms and registration. You can securely plan or re-check your numbers, and the platform offers you the clarity when you need it most.

Why TaxTools.ai Is the Best Tax Planning Tool for Everyday Americans

Most tax preparation programs present customers with unwarranted complexity. TaxTools.ai focuses on the opposite end by concentrating on what is really important, accuracy and convenience. All the calculators are currentized to current tax brackets, standard deductions, and federal regulations so that the results are comparable to the current tax regulations.

The platform is free of charge, so one can decide on how many times to pay taxes per month without concerns of subscriptions or surreptitious payments. This is particularly handy among workers who make the adjustments to their paycheck, families who budget, and freelancers who calculate their future commitments.

The Best Way to Understand State and Federal Taxes Together

The interaction between federal and state taxes is one of the greatest difficulties in tax planning. California tax calculator makes it easy by providing state-specific calculators that can be used in combination with federal estimates. The platform takes into consideration progressive systems, flat rates, and no-income tax states because each state has its own tax regulations.

This integrated perspective will enable users to have a more realistic image of the overall tax bill in 2026. It is especially useful to individuals who are either thinking of moving or bargaining for wages or even comparing jobs in different states.

How the Best Federal Tax Calculator Supports Smarter Decisions

The basis of all tax estimates is federal income taxes. TaxTools.ai is based on the official IRS formulas and covers all major filing statuses, such as Single, Married Filing Jointly, Married Filing Separately, and Head of Household.

The users are able to estimate their federal tax liability with a few inputs and plan their savings. This anticipatory measure will minimize unexpected situations at the time of filing and will facilitate superior yearly financial planning.

The Best Solution for Estimating Real Take-Home Pay

Gross income is not an indicator of your real post-tax income. TaxTools.ai fills this gap by assisting individuals in estimating their net income with federal and state deductions. The understanding is critical for budgeting, cost management, and having viable financial objectives in 2026.

The self-employed and gig workers will also be assisted by the use of future tools like paycheck calculators, deduction estimators, and quarterly tax planners as the platform further expands.

Is TaxTools.ai the Best Choice for Tax Calculations in 2026?

TaxTools.ai is worth the money to Americans who need to find a quick, precise, and tax-free method to compute taxes. Its current calculations, user-friendly design, and free accessibility make it a reliable source of year-round tax planning.

TaxTools.ai is one of the most helpful tools to impress in knowing and handling your finances in 2026 in an increasingly intricate tax setting.