The National Assembly’s Public Petitions Committee has received a petition seeking the repeal of a legal provision that exempts Kenya’s first two presidents from paying estate duty.

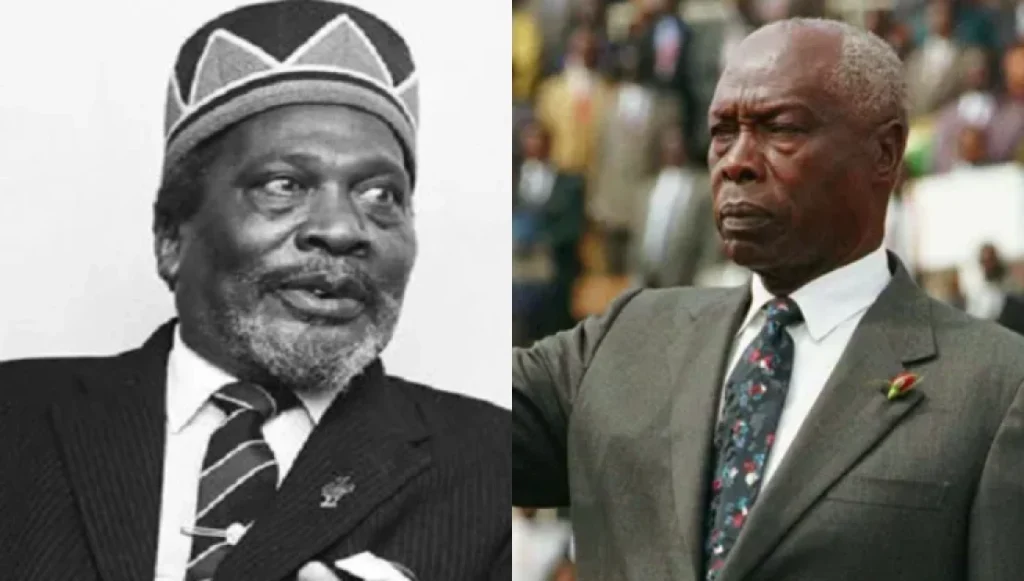

The petition, presented by John Wangai and Muhia Kagwe, calls for the removal of Section 7(3) of the Estate Duty Act (Cap. 483), which exempts the estates of former Presidents Mzee Jomo Kenyatta and Daniel arap Moi from paying estate tax. According to the petitioners, this section goes against Article 210(3) of the Constitution, which states that no law should allow the exclusion of a state officer from paying tax based on their office or duties.

The petitioners also argue that the exemption breaches Article 27 of the Constitution, which guarantees equality before the law and protection from discrimination.

However, the Committee, led by its Vice Chairperson and Turbo MP Janet Sitienei, pointed out that estate duty was abolished for all Kenyans under the Estate Duty (Abolition) Act of 1982.

“Are you aware of the Estate Duty Abolition Act of 1982 that abolished estate duty for everyone?” Sitienei asked the petitioners.

Wangai responded that their petition specifically focused on the continued existence of Section 7(3), which they believe still gives the impression of preferential treatment. He noted that despite the abolition law, the clause creates legal confusion and should be repealed.

Dagoretti North MP Beatrice Elachi supported the petition, saying it raises an important point about the need to update outdated laws.

“While the abolition law overrides the old provisions, we must appreciate the petitioners for helping to clean up our legal framework and remove ambiguity,” said Elachi.

Committee members acknowledged that outdated or conflicting sections in Kenya’s laws continue to appear in official documents and agreed there is a need for legal reforms to address such inconsistencies.

Email your news TIPS to Editor@Kahawatungu.com — this is our only official communication channel